Understand why EV insurance costs more than gas cars—and learn proven strategies to lower your premiums without sacrificing coverage.

Transitioning to an electric vehicle is often a savvy financial move, but many drivers are caught off guard by insurance premiums. Have you noticed that insuring an EV can sometimes cost more than a conventional combustion car? It’s a bit of a paradox.

In this guide, we’ll break down exactly why these rates fluctuate and, better yet, provide actionable strategies to lower your monthly costs without sacrificing essential coverage.

The Financial Landscape of Electric Vehicle Insurance

As of late, the market for electric vehicle insurance has been somewhat volatile. On the whole, we would say that the industry is still finding its footing with this technology. Recent data suggests that insuring an EV can cost anywhere from 20% to 50% more than a comparable internal combustion engine (ICE) vehicle. Somewhere in the shuffle of rapid tech advancement, the act of assessing risk became a moving target for underwriters.

This EV Premium exists for a few concrete reasons. Insurers are essentially risk-averse by nature, and they’ve been looking at a relatively small pool of historical data for EVs until just a few years ago. Now that millions of these cars are on the road, the data is getting clearer, albeit not always in the driver’s favor. Higher MSRPs, for instance, translate directly into higher potential payouts for the carrier.

That said, it is not all gloom and doom for your wallet. If you look at the total cost of ownership over five or ten years, the fuel and maintenance savings often eclipse the higher insurance costs. We think it’s important to view insurance as just one piece of the broader financial puzzle.

Speaking of which, once the repair infrastructure matures, we probably shall see these rates start to normalize across the board.

Factors Influencing EV Insurance Premiums

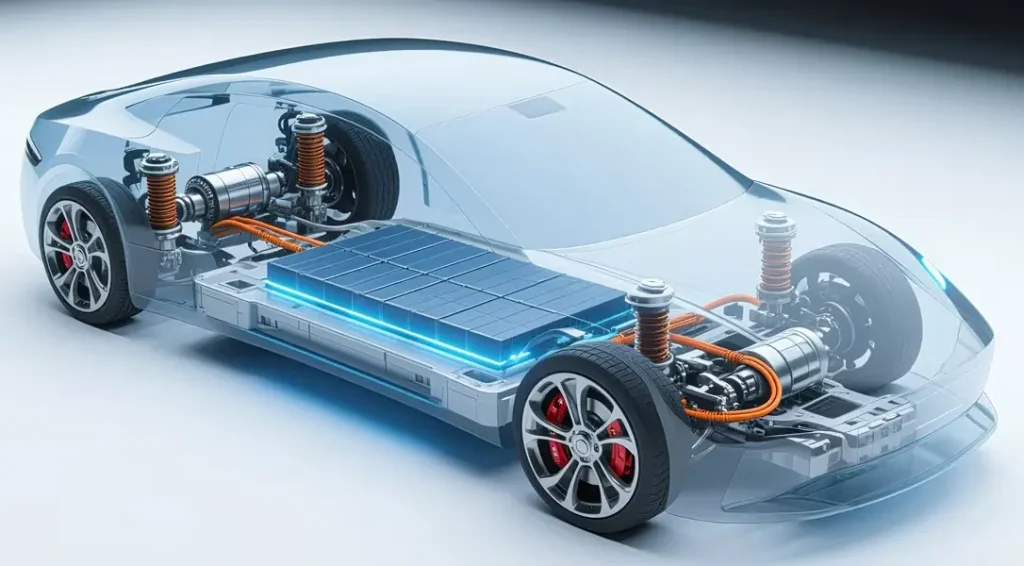

To understand how to save, you first have to understand what the insurance companies are actually looking at. It is not just the price tag on the window sticker. Elsewhere in the policy, specific mechanical and technological risks are being priced in.

Repair Costs and Specialized Parts

The reality of specialized labor is a major driver here. If you dent the fender of a ten-year-old sedan, practically any local shop can fix it for a few hundred bucks. But with an EV? You’re often dealing with proprietary alloys and components that require manufacturer-certified technicians. Honestly, there just are not enough of these specialists to go around yet, which keeps labor rates high.

Furthermore, high-tech sensors like LiDAR and specialized cameras are often embedded in the very bumpers and windshields that get cracked in minor accidents. Instead of a simple glass replacement, you’re looking at recalibration fees that can cost as much as the glass itself. It’s a bit of a headache, you know?

Battery Replacement Value

The battery pack is, without question, the single most expensive component of your car. In some models, the battery alone can account for 30% to 50% of the vehicle’s total value, which is why proper EV battery charging and maintenance habits play such an important role in extending battery life and avoiding premature replacement. Consequently, insurers are extremely sensitive to any damage that might compromise the pack.

Strangely, even a minor undercarriage scrape can sometimes lead an insurer to declare the entire vehicle a total loss. They do this because they can’t always verify the internal integrity of the cells. Since they’d rather not risk a thermal runaway event later on, they simply “total” the car. This high total-loss frequency is a primary reason why your premiums have been creeping up. For a real-world example of how expensive this can get, especially with Teslas, you can take a deeper look at the actual numbers on Tesla battery replacement cost.

Safety Features and Driver Assistance Systems

It’s a bit of a double-edged sword. On one hand, EVs are some of the safest vehicles ever tested by the IIHS and NHTSA. Features like automatic emergency braking and lane-keep assist definitely reduce the frequency of accidents. In general principle, fewer accidents should mean lower rates.

However, when these systems do fail or get damaged, the cost to bring them back online is staggering. To our eyes, we’re in a transition period where the safety benefits have not quite offset the “tech-repair” tax in the eyes of the actuaries.

Strategies to Reduce Your EV Insurance Costs

Now, let’s move to the most substantial part of the discussion. How do you actually keep that save cost on premium? There are several direct, practical steps you can take today to trim the fat from your policy.

Bundling and Multi-Vehicle Discounts

This is the oldest trick in the book, but it’s still the most effective. If you have homeowners or renters insurance, moving your EV policy to that same provider can often trigger a discount of up to 25%. We’ve seen cases where the savings on the home policy actually paid for a chunk of the car insurance.

Even better, if you have a mix of vehicles. Say, an EV for commuting and a gas SUV for road trips, insuring them together under a multi-car discount is almost always cheaper than separate policies.

Telematics and Usage-Based Insurance (UBI)

If you’re a safe driver and you don’t mind a bit of digital oversight, telematics could be your best friend. Many insurers now offer apps that track your braking, acceleration, and the time of day you drive. For the average EV enthusiast who prides themselves on efficient, smooth driving to maximize range, these programs are a natural fit. You might arguably save another 10% to 30% just by proving you’re not a stoplight drag racer.

Maintaining a Clean Driving Record

Long story short, do not get tickets. In terms of impact, a single speeding violation can spike an EV premium much harder than a gas car premium because of the high replacement values involved. Some carriers also offer discounts if you complete a certified defensive driving course. It’s well worth the few hours of your time if it knocks 10% off your bill for the next three years.

The Impact of Low Annual Mileage

Because many EVs are used primarily as city cars or daily commuters, they often rack up fewer miles than the national average. If you’re driving less than 7,500 miles a year, you should absolutely mention this to your agent. Nowhere is it written that a low-mileage EV should be priced the same as a long-distance hauler.

Specialized Coverage Options Worth Considering

Sometimes saving money is not just about the monthly premium; it’s about avoiding a massive out-of-pocket expense later. You want to tailor the policy to the quirks of electric ownership.

Gap Insurance for New EV Owners

This is particularly vital. Tech-heavy models can depreciate rapidly when a new version or a price cut hits the market. If your car is totaled and you owe more on the loan than the car is worth, you’ll be left holding the bag for the difference. Gap insurance bridges that—well, gap. Having said that, check if your lender already includes it before you double-pay.

Coverage for Home Charging Stations

Is your Wallbox covered? Most people assume their auto policy covers it, but since it’s bolted to your house, it usually falls under homeowners insurance. Neither policy might cover it automatically if you don’t declare it. Make sure it’s listed as a permanent fixture so you are not stuck paying $1,000 for a new charger if a power surge fries it.

Comparing Providers and Negotiating Rates

We cannot stress this enough: shop around. The big name insurers all have different appetites for EV risk. One company might not like Teslas but love Rivians. Another might have just updated their algorithm and is now offering green vehicle discounts of 10% to attract eco-conscious customers.

Every six months, take thirty minutes to run your numbers through a comparison tool. Speaking of which, if you find a better rate elsewhere, don’t be afraid to bring it to your current agent. Sometimes they have retention discounts they can magically apply only when you’re halfway out the door. It’s a bit of a game, but a game you can win.

Concluding Thoughts

Browsing for the best EV insurance can feel like a part-time job sometimes. But as the technology matures and more shops become certified, we’ll likely see the EV tax on insurance start to fade.

Until then, the odds are in your favor if you stay proactive. By bundling, leverage telematics, and shopping around frequently, you can ensure your electric transition is as good for your bank account as it is for the planet.

Stay smart, stay safe, and honestly, keep that driving record clean, it’s the best discount you’ll ever get.

And if you’re looking for a portable EV charger, a home charging station wallbox, or the latest accessories, Duevolt has you covered. Feel free to check out our full range today!

Frequently Asked Questions

Why is insurance more expensive for EVs than gas cars?

The primary drivers are repair complexity and parts availability. Since there are fewer aftermarket parts for EVs compared to gas cars, insurers have to pay for expensive OEM (original equipment manufacturer) components. On top of that, the labor hours required for de-energizing a high-voltage system before repair adds to the final bill.

Do all insurance companies offer “Green Vehicle” discounts?

Not all of them, no. While common, these discounts vary significantly by state and provider. Some companies prefer to bake the “green” aspect into the base rate, while others use it as a specific marketing incentive. It’s always worth asking specifically, “Do you have an alternative fuel discount?”

Should I increase my deductible to save money?

Maybe. If you have a solid emergency fund, raising your deductible from $500 to $1,000 can lower your premium by a decent margin. However, given that EV repairs are almost always expensive, you’re much more likely to hit that deductible even in a minor incident. We’d say you should only do this if you’re comfortable with the risk.

Does the model of my EV affect the rate significantly?

Absolutely. There is a world of difference between insuring a Nissan Leaf and a Tesla Model S Plaid. High-performance EVs with insane 0-60 times are viewed as higher risks for obvious reasons. More sensible commuter EVs generally enjoy much lower rates because they aren’t associated with performance driving.